Table of Content

- What is cashback

- What is affliate

- How does cashback work

- Where can I get cashback

- Cashback websites

- Cashback debit card

- How to choose right cash back debit card

- Is cashback taxable

- Is cashback worth it

- How long does cashback take

What is cashback?

Cashback is a reward system where stores give back some money to you after you buy something. It’s like getting a little bit of your money back as a thank you for shopping. Cashback started with credit cards, but now you can find it with debit cards, in stores, and when you shop online.

Cashback can come in different forms, like actual cash, points you can use later, or coupons. It’s for everyone who buys things, so you can use cashback to spend less money.

What is affliate?

Affiliate marketing is when a company pays people (called affiliates) to promote their products or services. The company pays them a commission based on how well they do (like making sales or getting clicks). It’s usually for people who can promote things, like bloggers or social media influencers. The main goal is to reach more customers and sell more stuff.

How does cashback work?

The way cashback works is essentially through a commission-sharing model, but different forms of cashback have specific differences in their operational rules. The basic principle of cashback is as follows:

Partnership between merchants and platforms:

Merchants (such as e-commerce platforms or retailers) partner with cashback platforms (like cashback websites or credit card companies). The merchants agree to pay a certain percentage of commission to the platform in exchange for the platform promoting their products or services.

Consumers shop through the platform:

Consumers purchase goods or services through links or channels provided by the cashback platform. The platform tracks the consumer’s purchase behavior and confirms the completion of the transaction.

Platform shares part of the commission:

After receiving the commission from the merchant, the platform returns a portion of it to the consumer in the form of cashback. This cashback can be in the form of cash, points, coupons, etc.

Here’s how different types of cashback work:

Cashback Websites:

Consumers create an account on a cashback website and shop through the links provided by the site. The website tracks the consumer’s purchases and records the cashback amount in their account. Once the cashback reaches a certain amount, the consumer can withdraw it or exchange it for other rewards.

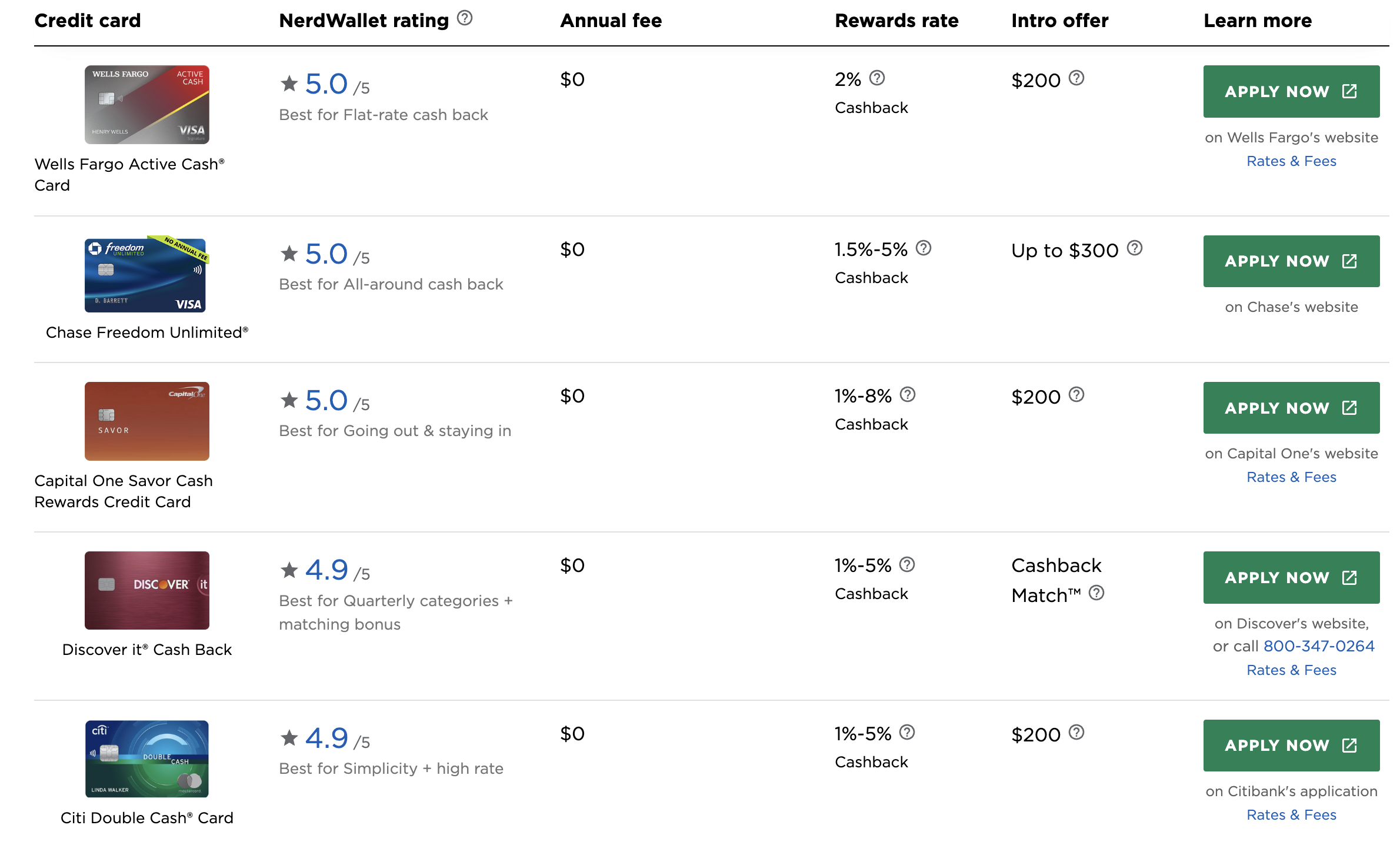

Credit Card Cashback:

Credit card companies partner with merchants to offer cashback to cardholders for purchases made at specific stores or for all transactions. When the cardholder uses their credit card, the cashback amount is automatically added to their credit card account. This cashback can be used to offset the credit card bill or exchanged for other rewards.

Debit Card Cashback:

Debit card cashback works similarly to credit card cashback, but the cashback rate is usually lower. Some banks or merchants offer debit card accounts that provide a certain percentage of cashback when consumers use their debit cards for purchases. The cashback amount is typically credited directly to the debit card account.

Where can I get cashback

To get cashback, consider using cashback websites or their browser extensions, which automatically display cashback rates and find coupons when you shop online. Credit cards offer cashback or points on everyday purchases, redeemable for gift cards or discounts, but be mindful of minimum spending requirements. Some debit cards also provide cashback rewards.

Additionally, retailer loyalty programs and mobile apps offer cashback or points for purchases, sometimes requiring receipt scanning. Always review the terms and conditions before joining any cashback program.

Cashback websites

Cashback websites are all about getting money back when you shop. Basically, you sign up for a cashback website, and when you buy things through their links, the stores give them a commission. They then share some of that commission with you, so you end up saving money. Here are some cashback websites for your reference:

Topcashback

TopCashback is one of the leading cashback and rewards platforms that helps users earn money back on their everyday purchases. It partners with thousands of retailers, brands, and service providers to offer cashback on a wide range of products and services, including shopping, travel, insurance, and more. Whether you’re shopping online or in-store, TopCashback provides a simple and effective way to save money on things you already buy.

Cashback Easy

CashbackEasy, an emerging cashback platform, has quickly gained recognition for its unique market positioning and high-quality services. The platform has integrated over 5,000 renowned retailers, including international top brands like Amazon, Temu, and Kohl’s, creating a comprehensive cashback ecosystem. Through its intelligent coupon matching system, CashbackEasy automatically filters the best discount combinations for users, achieving a dual benefit of “cashback + coupons” to maximize shopping savings.

As a new player in the industry, CashbackEasy demonstrates a significant competitive advantage in cashback rates, generally offering higher returns than traditional cashback platforms. Additionally, the platform has introduced an exclusive rewards program for new users, providing extra benefits for first-time users. This innovative business model not only reflects the platform’s commitment to user value but also highlights its determination to capture market share.

Visit the official website now to start your smart cashback journey and experience a new way to save on your shopping like never before.

Rakuten

Rakuten is a trusted and reliable platform that makes saving money effortless. Whether you’re shopping for everyday essentials or planning a big purchase, Rakuten helps you earn cashback on things you already buy. With its easy-to-use interface, frequent promotions, and flexible payout options, Rakuten is a must-have tool for savvy shoppers.

Cashback debit card

what is cashback on a debit card

Cashback on a debit card is a reward system where you earn a small percentage of money back on purchases made using your debit card. It works similarly to cashback on credit cards but is tied directly to your bank account rather than a credit line.

How does debit card work

Eligible Purchases: When you use your debit card to make purchases at participating retailers or for specific categories (e.g., groceries, fuel, or online shopping), you earn a percentage of the amount spent as cashback.

Cashback Percentage: The cashback rate is usually a small percentage (e.g., 1-5%) of the purchase amount, depending on the bank or retailer’s offer.

Accumulation: The cashback you earn is accumulated over time, either as points or directly as money.

Redemption: Once you’ve earned enough cashback, you can redeem it. This might involve:

Receiving the cashback as a direct deposit into your bank account. Using it as a discount on future purchases. Converting it into vouchers or gift cards.

No Interest or Debt: Unlike credit card cashback, debit card cashback doesn’t involve borrowing money, so there’s no risk of interest charges or debt if you don’t pay off a balance.

For example, If your debit card offers 2% cashback on groceries and you spend USD100 at a supermarket, you would earn USD2 in cashback. Over time, these small amounts can add up

How to choose right cash back debit card

Understand Your Spending Habits

Analyze where you spend the most money (e.g., groceries, fuel, online shopping, dining, etc.). Look for a card that offers higher cashback rates in those categories.

Compare Cashback Rates

Check the cashback percentage offered by different cards. Some cards may offer:

Flat-rate cashback (e.g., 1% on all purchases).

Tiered cashback (e.g., 3% on groceries, 2% on fuel, 1% on other purchases).

Choose a card that aligns with your spending patterns.

Check for Fees

Some cashback debit cards may have monthly or annual fees. Ensure the cashback you earn outweighs any fees. Look for cards with no hidden charges or minimum balance requirements.

Review Redemption Options

Check how and when you can redeem your cashback. Some options include:

Direct deposit into your bank account.

Statement credits.

Gift cards or vouchers.

Choose a card with flexible and convenient redemption options.

Check for Spending Limits or Caps

Some cards may have a cap on how much cashback you can earn in a month or year. If you’re a high spender, choose a card with no or high cashback limits.

Cash back debit card checklist:

| Feature | What to Look For |

| Cashback Rate | High rates in your most-used categories. |

| Fees | Low or no fees. |

| Redemption Options | Flexible and easy to use. |

| Sign-Up Bonus | Attractive welcome offers. |

| Spending Caps | No or high limits. |

| Additional Perks | Useful extras like discounts or insurance. |

| Fine Print | No hidden restrictions. |

Check here for more info about the best cashback debit card.

Is cashback taxable

The taxability of cashback can vary depending on how it’s earned.

Generally Not Taxable:

Cashback from Purchases:

Most cashback rewards earned from making purchases (whether through credit cards, debit cards, or cashback websites) are generally considered rebates or discounts. The IRS typically does not treat these as taxable income. Essentially, they’re viewed as a reduction in the purchase price.

Potentially Taxable:

Rewards Not Tied to Purchases:

If you receive cashback or rewards simply for opening an account or for other activities not directly related to purchases, it could be considered taxable income. For example, large sign-up bonuses that don’t require spending may be taxable. Also referral bonuses could be taxable.

1099-MISC Form:

In some cases, if you receive a significant amount of rewards (often $600 or more) that are considered taxable, the issuer may be required to send you a 1099-MISC form. This form reports non-employment income to the IRS.

Business Rewards:

Rewards earned on business credit cards can affect how business expenses are deducted.

Is cashback worth it

Cashback is basically a reward system that stores use to encourage you to buy things. You can get cashback in lots of ways, like through cashback websites, credit cards, debit cards, store loyalty programs, and mobile apps.

When you shop online through cashback websites or their browser extensions, you can automatically get money back and find coupons. With credit and debit cards, you earn cashback or points on your everyday purchases, and you can use those points for gift cards or discounts. Store loyalty programs and mobile apps give you similar cashback or point rewards.

Whether cashback is worth it depends on your spending habits and money goals. If you’re good with money, cashback is an easy way to save, but don’t spend more than you should just to get rewards. Most cashback from shopping isn’t taxed, but some rewards you get without buying anything might be. Always read the rules before you join any cashback program, and pick the ones that fit how you usually spend money.

How long does cashback take?

The time it takes to receive cashback depends on the specific program, bank, or retailer you’re using.

Bank Debit Card Cashback: Often credited monthly or after reaching a minimum threshold.

Cashback Websites (e.g., TopCashback, Quidco): Typically take 1-3 months, depending on the retailer’s return policy and verification process.

Retailer-Specific Cashback: Some stores offer instant discounts or cashback that appears within a few days.